income tax number malaysia

In other words the more you earn the higher the percentage of tax you need to pay. It takes just four steps to complete your income tax number registration.

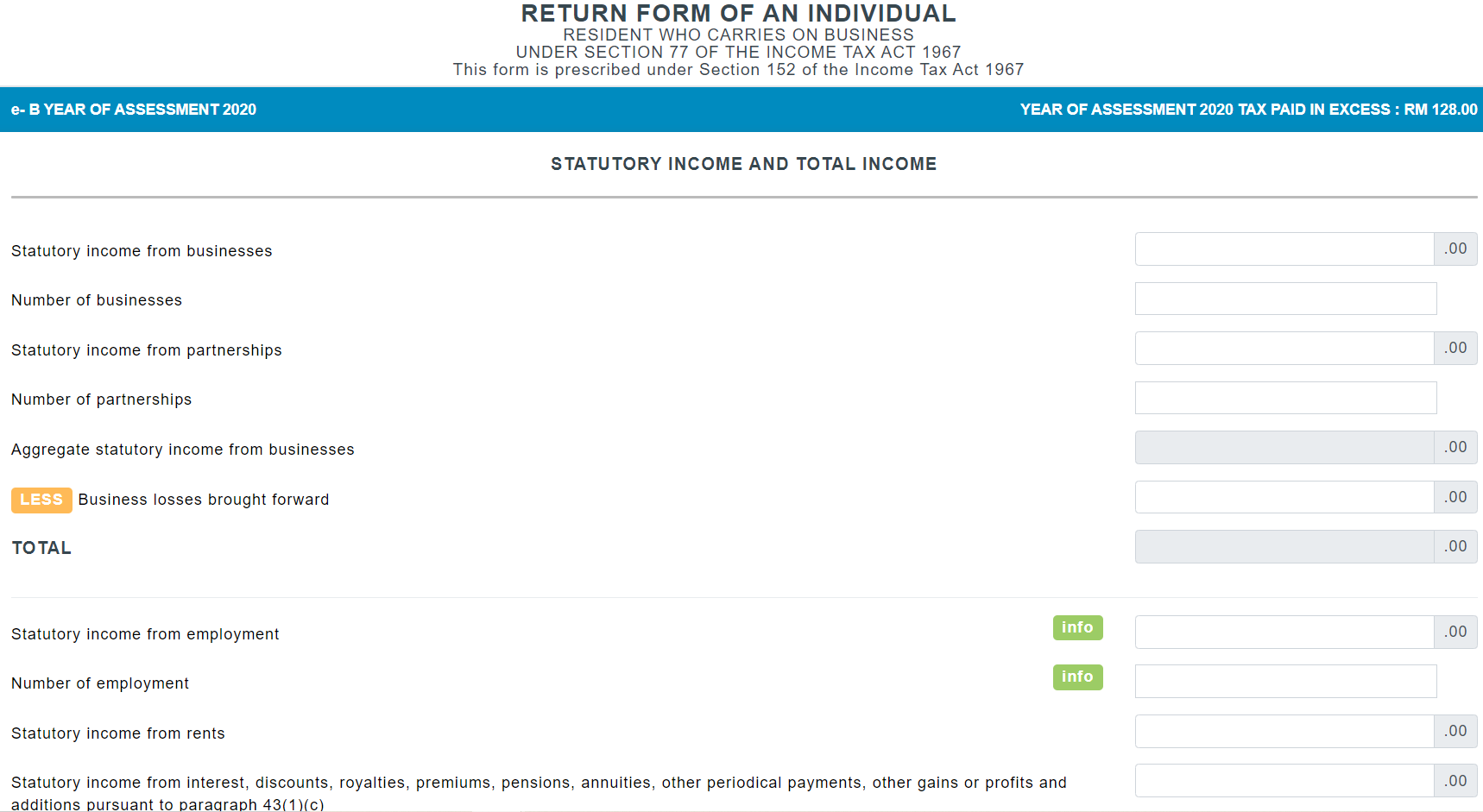

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Obtaining an Income Tax Number If you do not hold but require an Income Tax Number you should.

. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. 19 September 2022 Download. Steps to check Income Tax Number are very simple.

Unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the IRBM to identify its taxpayers. Obtaining an Income Tax Number Visit the official Inland Revenue Board of Malaysia website. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification type New IC.

The tax rate in Malaysia is always a percentage of your chargeable income. Normally companies will obtain the income tax. 08022022 By Stephanie Jordan Blog.

To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. That said that higher. Once you know your income tax number you can pay your.

It has about 100 branches including UTC nationwide. A Copy 1 Memorandum and Articles of Association 2. TIN is the income tax number currently recorded by the Inland Revenue Board of Malaysia.

03-8911 1000 local number What is Income Tax File number Malaysia. You may find out by phoning the LHDN Inland Revenue Board be prepared to provide your identification card or passport number. Alex Cheong Pui Yin.

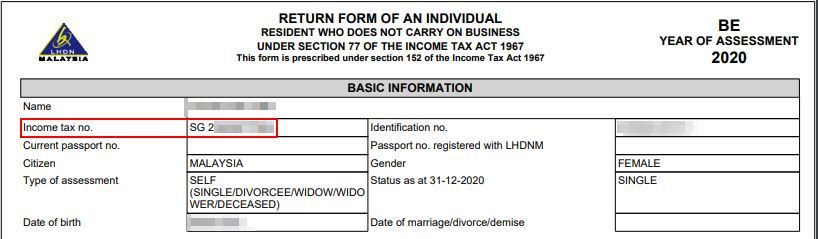

Starting from January 2021 all Malaysians above the age of 18 and corporate entities will be assigned a Tax Identification Number TIN said Deputy Finance. Non-residing individuals are subjected to pay tax at a flat rate of 30 from 2020. For example the file numbers of individual residents and non-residents are SG and.

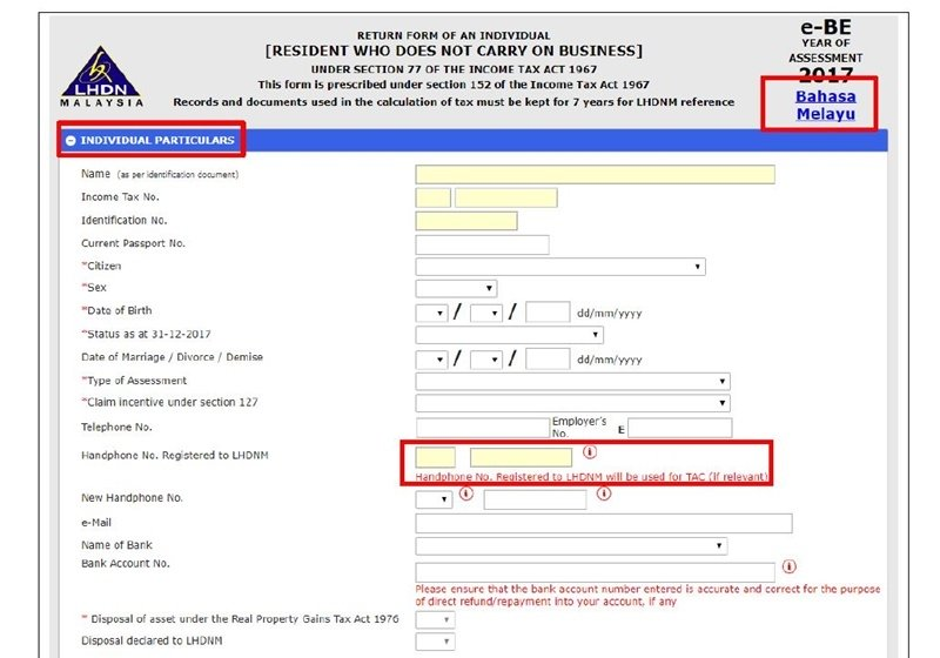

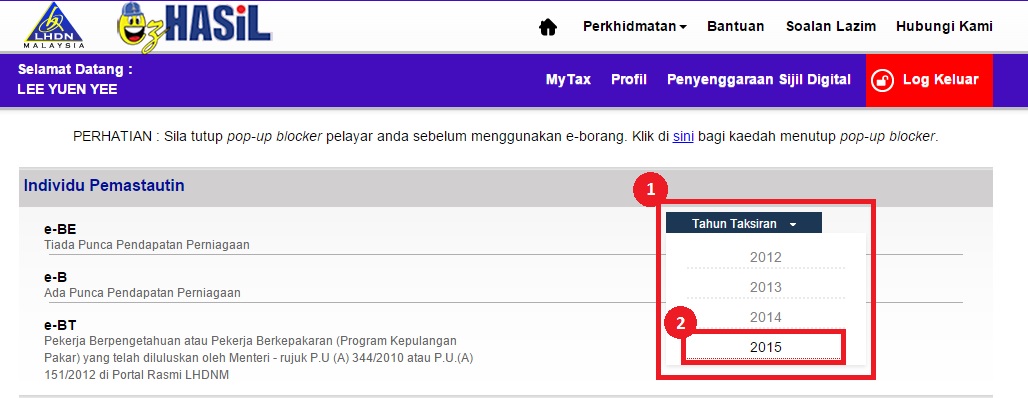

Heres a more detailed. It will be applied to your. To get your income tax number youll need to first register as a taxpayer on e-Daftar.

The table below shows fields of foreign income against income tax percentage rate in Malaysia. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable. This Income Tax Office info page is to provide information such as address telephone no fax no office hours and etc.

Lets take a look at the registration steps. It is necessary for you to use your Income Tax Number also known as Lembaga Hasil Dalam. Section II TIN Structures 1 ITN The ITN consist of maximum.

We have prepared the steps to check for the Income Tax Number. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia.

Visit LHDN Website LHDN website. Register Online Through e-Daftar Visit the official Inland Revenue Board of Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport.

Once the new page has loaded click on the relevant. After that you can obtain your PIN online or by visiting a LHDN branch. Before you can file your taxes online there are two things that you will need.

Forward the following documents together with the application form to register an income tax reference number E-Number- 1. 7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1. It is also commonly known in Malay as Nombor Rujukan Cukai.

How To File Income Tax For The First Time

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

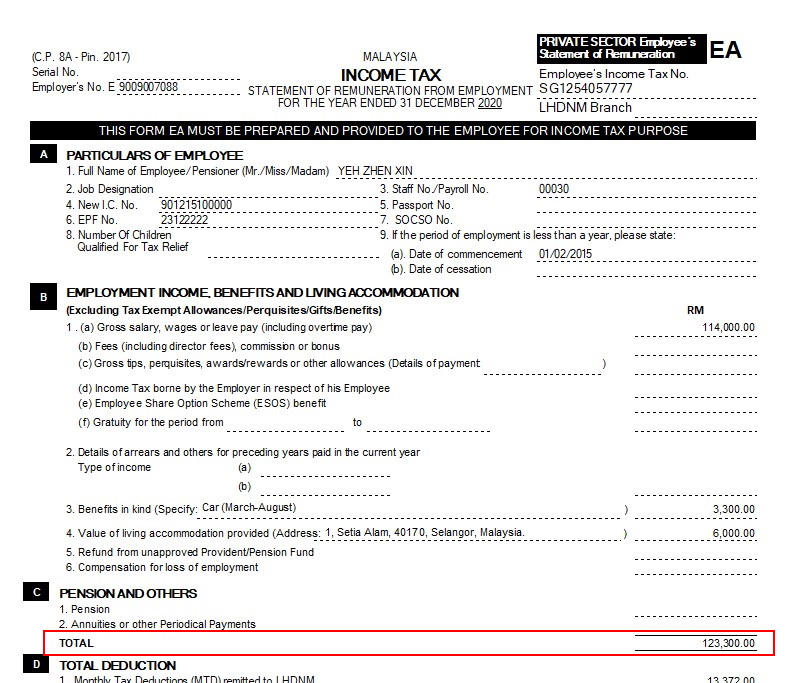

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

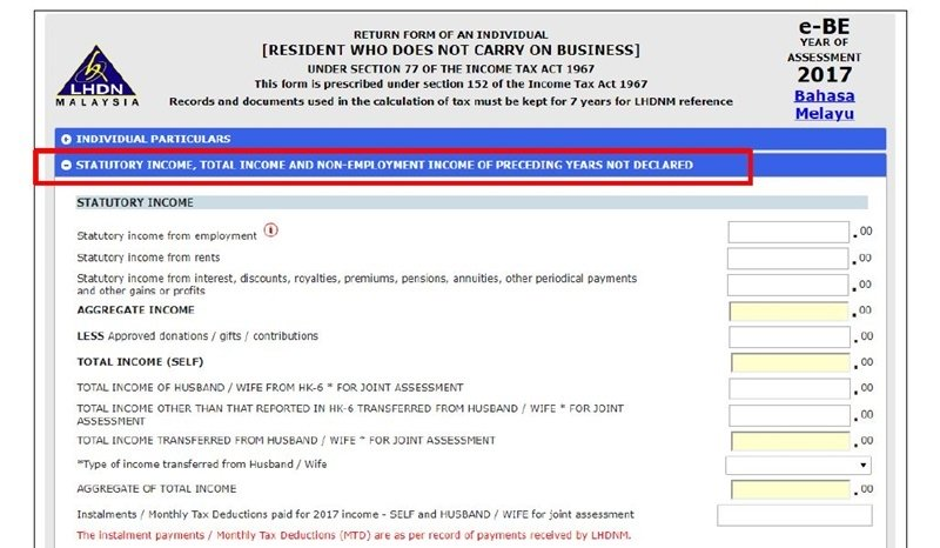

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Malaysia Personal Income Tax Guide 2020 Ya 2019

Beginner S Guide Investing Abroad Via Interactive Brokers From Malaysia

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Malaysia Personal Income Tax Guide 2020 Ya 2019

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

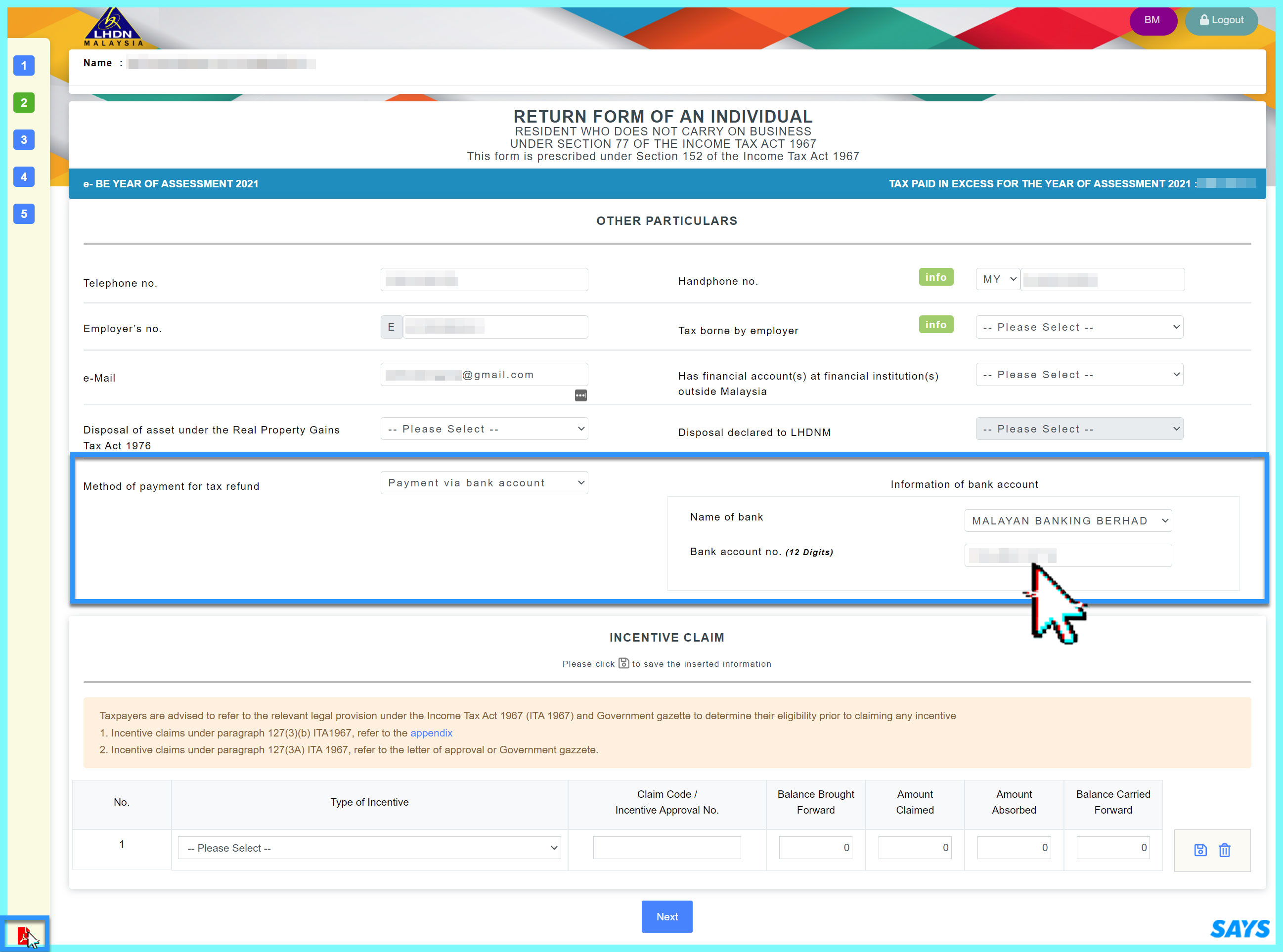

How To File Income Tax In Malaysia Using E Filing Mr Stingy

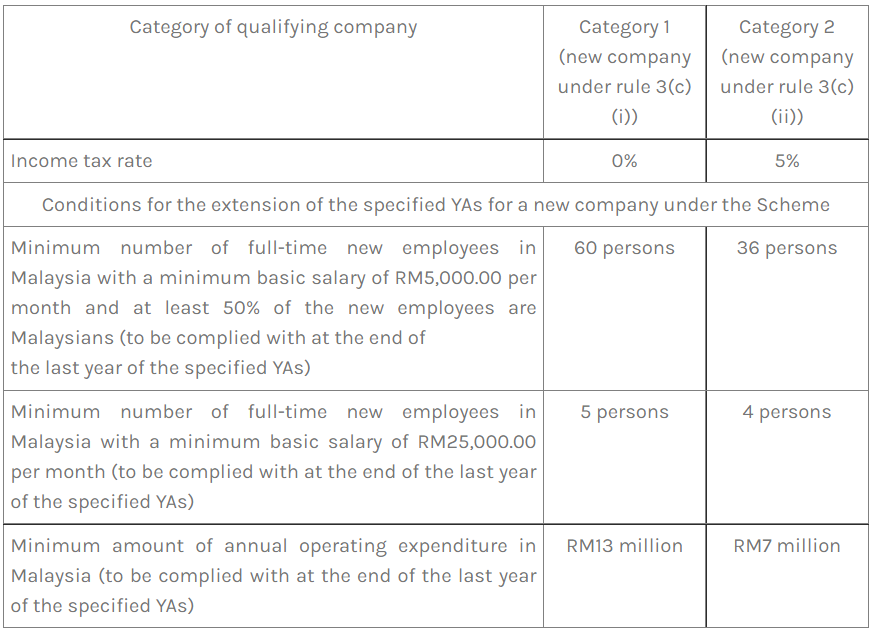

Principal Hub Tax Incentive Rules 2022 Lexology

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Income Tax Everything They Should Have Taught Us In School The Full Frontal

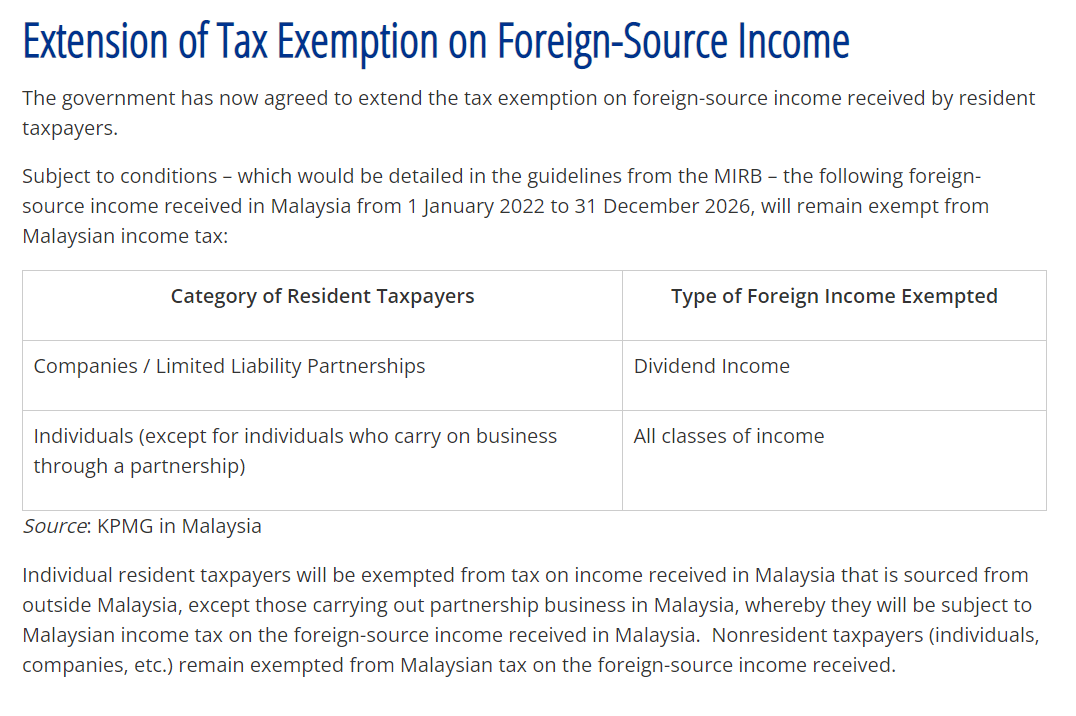

Come Jan 1 2022 Foreign Sourced Income Received In Chegg Com

Income Tax Collection Vital For The Malaysia We Love

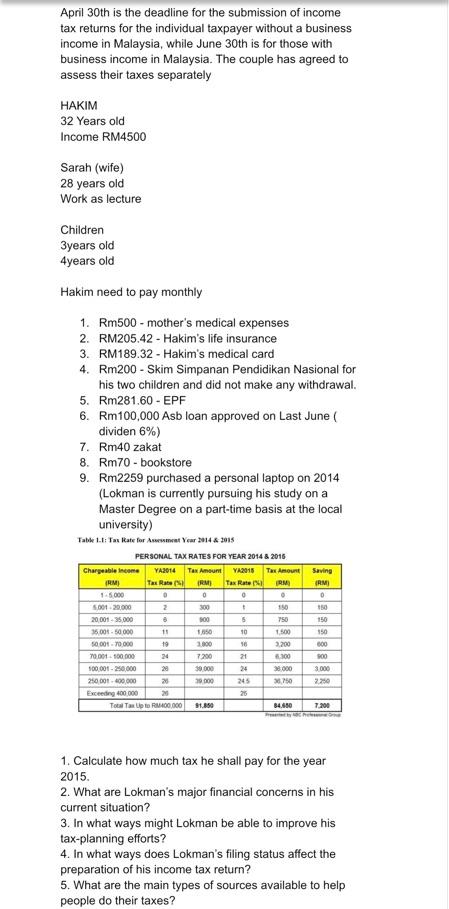

April 30th Is The Deadline For The Submission Of Chegg Com

0 Response to "income tax number malaysia"

Post a Comment